When opening a savings account or certificate of deposit, you’ll see two important numbers: dividend rate and APY. Many people get confused when comparing dividend rate vs APY and how each affects their savings. Don’t worry! This guide explains both concepts in simple words so you can make better money decisions.

What is Dividend Rate?

Simple Definition

The dividend rate is the basic interest rate your bank or credit union pays on your account. Think of it as the starting point. It shows how much interest you earn before any compounding happens.

For example, if your savings account has a 4% dividend rate, the bank promises to pay you 4% interest on your money each year.

To learn more about financial topics like dividend rate vs APy check out other helpful guides on our divireinvest website

How Dividend Rate Works

Let’s say you deposit $1,000 in a savings account with a 4% dividend rate:

- Your account earns $40 in interest per year

- This calculation is straightforward: $1,000 × 0.04 = $40

- The dividend rate doesn’t include compound interest

Banks and credit unions calculate interest based on this rate. However, the dividend rate alone doesn’t tell the complete story of your earnings.

What is APY?

APY Full Form and Meaning

APY stands for Annual Percentage Yield. This number shows the total amount you’ll earn in one year, including compound interest. APY gives you the real picture of your returns.

The APY is always equal to or higher than the dividend rate because it includes the magic of compounding. This makes it an essential part of understanding the difference between dividend rate vs APY.

Understanding Compound Interest

Compound interest means earning interest on your interest. Here’s a simple example:

Month 1: You have $1,000 and earn $3 in interest Month 2: You now have $1,003 and earn interest on this new amount Month 3: Your interest grows even more because the base amount keeps increasing

This compounding effect makes APY more valuable than the simple dividend rate.

Key Differences Between Dividend Rate and APY

The Main Differences

Dividend Rate:

- Shows simple interest only

- Does not include compounding

- Lower number than APY

- Basic interest calculation

- Starting point for earnings

APY:

- Includes compound interest

- Shows actual yearly earnings

- Higher number than dividend rate

- More accurate for planning

- Real return on your money

Why APY is More Important

When comparing accounts, always look at APY first. Here’s why:

- Accurate Comparison: APY lets you compare different accounts fairly

- Real Earnings: It shows what you actually earn

- Standardized: All banks calculate APY the same way

- Complete Picture: Includes all compounding benefits

The dividend rate is useful to know, but APY tells you the truth about your returns.

Real-World Example: Dividend Rate vs APY

Practical Calculation

Let’s compare two scenarios with $5,000 deposited:

Account A:

- Dividend Rate: 4.00%

- Compounds monthly

- APY: 4.07%

- Yearly earnings: $203.50

Account B:

- Dividend Rate: 4.00%

- Compounds daily

- APY: 4.08%

- Yearly earnings: $204

Both accounts have the same dividend rate, but different APYs. Account B earns slightly more because it compounds daily instead of monthly.

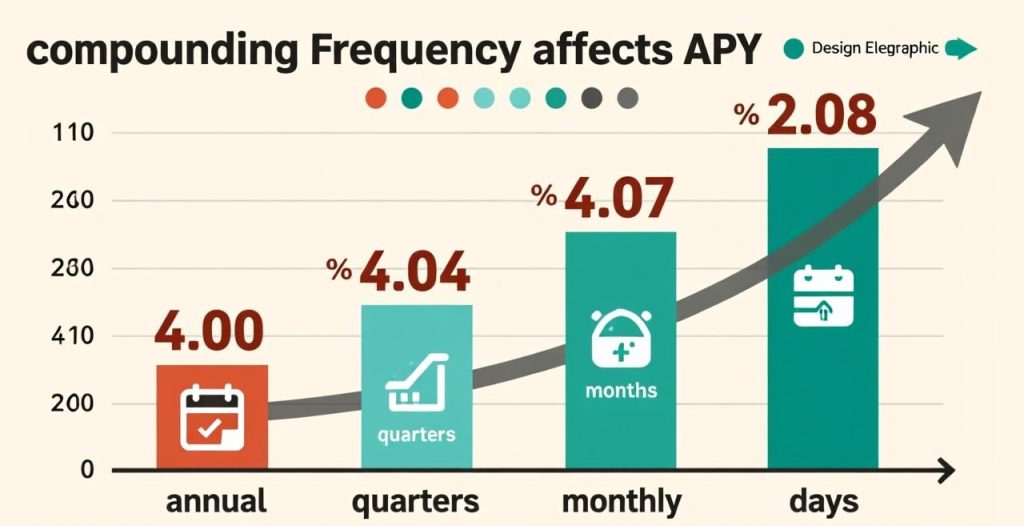

How Compounding Frequency Matters

Compounding frequency affects APY:

- Daily compounding: Highest APY

- Monthly compounding: Medium APY

- Quarterly compounding: Lower APY

- Annual compounding: Lowest APY (equals dividend rate)

More frequent compounding means higher APY, even with the same dividend rate.

For more smart savings comparisons, visit this guide

Which One Should You Focus On?

For Savers and Investors

Always prioritize APY when choosing accounts. Here’s your simple checklist:

- Compare APYs: Look at APY numbers across different banks

- Check Terms: Make sure there are no hidden fees

- Understand Requirements: Some high APYs need minimum balances

- Read Fine Print: Verify the APY is guaranteed

The dividend rate matters less for decision-making. APY is your go-to number.

For Account Holders

If you already have an account:

- Check your current APY regularly

- Compare it with other available options

- Consider switching if you find significantly higher APY

- Remember that a 1% difference in APY means real money over time

Common Mistakes to Avoid

Don’t Make These Errors

Mistake 1: Choosing Based on Dividend Rate Always compare APY, not dividend rates. Two accounts with the same dividend rate can have different APYs.

Mistake 2: Ignoring Compounding Frequency Daily compounding is better than monthly or quarterly. Check how often interest compounds.

Mistake 3: Forgetting About Fees High APY means nothing if monthly fees eat your earnings. Calculate net returns after fees.

Mistake 4: Not Shopping Around APY rates change frequently. Review your options every 6-12 months to ensure you’re getting the best deal.

How to Calculate APY from Dividend Rate

Simple Formula

You don’t need to be a math expert. Here’s the basic idea:

APY = (1 + dividend rate / compounding periods)^compounding periods – 1

Example:

- Dividend rate: 4% (0.04)

- Compounds monthly (12 times per year)

- APY = (1 + 0.04/12)^12 – 1

- APY = 4.07%

Most banks show both numbers, so you rarely need to calculate manually.

Tips for Maximizing Your Returns

Understanding dividend rate vs APY can help you choose the right account and apply these smart savings strategies more effectively

Smart Savings Strategies

- Look for High APY Accounts: Online banks often offer better APY than traditional banks

- Maintain Minimum Balances: Many high APY accounts require minimum deposits

- Avoid Withdrawals: Some accounts reduce APY if you withdraw too often

- Consider CDs: Certificates of deposit often have higher APY than savings accounts

- Review Regularly: APY changes with market conditions

Long-Term Planning

Understanding dividend rate vs APY helps with:

- Emergency fund planning

- Retirement savings calculations

- Education fund estimates

- Short-term savings goals

Even a small difference in APY compounds to significant money over years.

Conclusion

The difference between dividend rate and APY is simple: dividend rate is the basic interest, while APY shows your real earnings with compound interest included.

Remember:

- APY is always more important for comparing accounts

- Higher compounding frequency means better APY

- A small APY difference creates big returns over time

- Always read account terms carefully

Focus on APY when making financial decisions. It’s the number that truly reflects what you’ll earn on your savings.

Whether you’re saving for short-term goals or long-term plans, knowing the difference between dividend rate vs APY ensures you make smarter financial decisions.

FREQUENTLY ASKED QUESTIONS (FAQs)

Q1: Is APY always higher than the dividend rate?

Yes, APY is always equal to or higher than the dividend rate. When interest compounds more than once per year, APY will be higher. If interest compounds only once annually, APY equals the dividend rate.

Q2: Which is better: 4.5% dividend rate or 4.6% APY?

Always choose the higher APY. A 4.6% APY gives you more actual earnings than a 4.5% dividend rate because APY includes compound interest.

Q3: Do all banks show both dividend rate and APY?

Most banks display both numbers. However, by law, banks must show APY on savings accounts and CDs. The APY is the legally required disclosure number.

Q4: Can APY change over time?

Yes, APY can change. Variable rate accounts adjust APY based on market conditions. Fixed-rate CDs lock in your APY for the term length. Always verify whether your APY is fixed or variable.

Q5: How often should interest compound for the best returns?

Daily compounding offers the best returns. The more frequently interest compounds, the higher your APY and total earnings will be.