What is JEPI and Why Investors Love It

JEPI stands for JPMorgan Equity Premium Income ETF. This fund is popular among income investors. It pays monthly dividends. Many people use a JEPI dividend calculator to plan their passive income.

The fund combines stock investing with option strategies. This creates regular monthly payments. JEPI focuses on generating income while managing risk.

Understanding JEPI Dividend Payments

How JEPI Dividends Work

JEPI pays dividends every month. The dividend yield typically ranges between 7% to 11% annually. However, monthly payments can vary.

Unlike some ETFs, JEPI’s dividend is not fixed. The monthly distribution changes based on market conditions. This makes using a dividend calculator for JEPI very helpful.

JEPI Dividend History and Yield

Historical data shows JEPI maintains strong dividend payments. The fund started in May 2020. Since then, it has consistently paid monthly dividends.

Current JEPI dividend yield attracts income-focused investors. You can track JEPI dividend history on financial websites like Yahoo Finance.

How to Use a JEPI Dividend Calculator

Basic Calculation Method

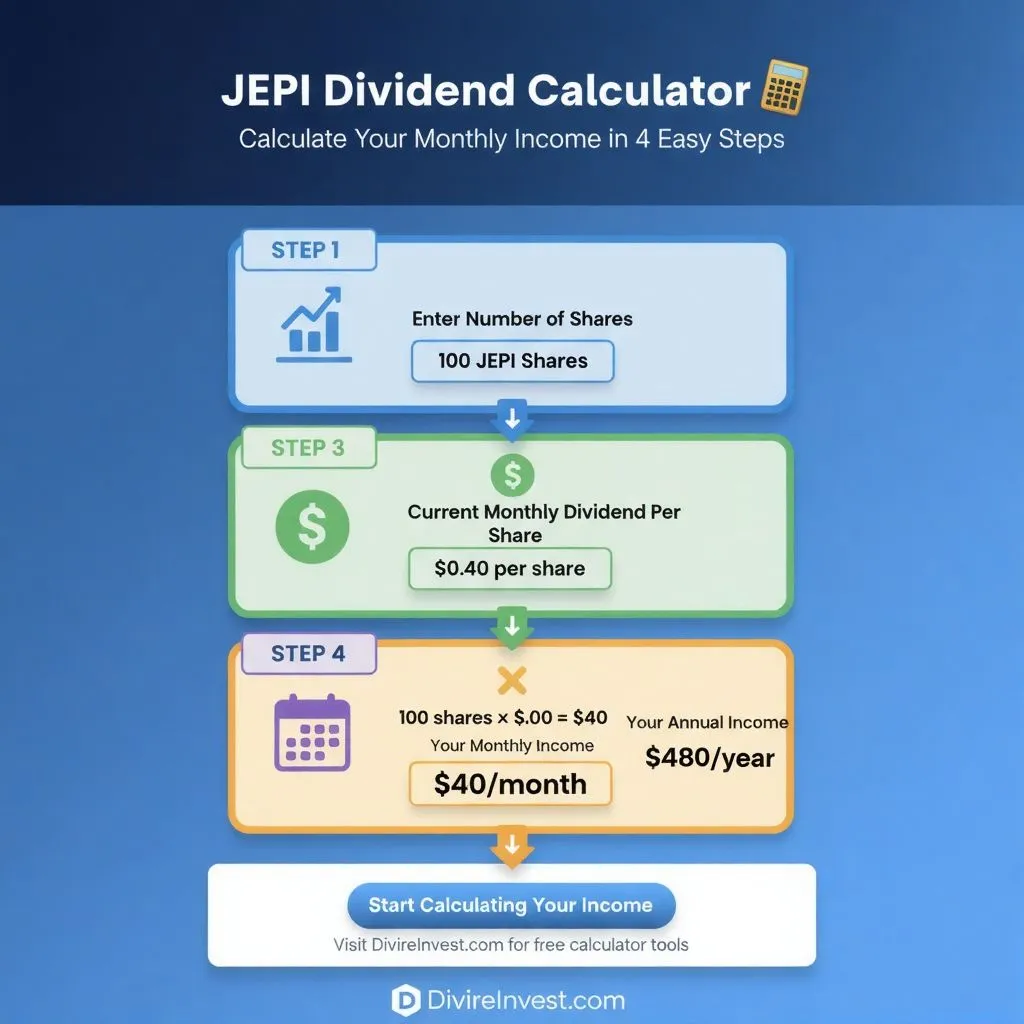

Calculating JEPI dividends is simple. You need three things:

- Number of shares you own

- Current dividend per share

- Payment frequency (monthly)

Formula: Annual Income = Shares × Dividend Per Share × 12

For example, if you own 100 shares and the monthly dividend is $0.40:

- Monthly Income = 100 × $0.40 = $40

- Annual Income = $40 × 12 = $480

Advanced JEPI Income Projection

A JEPI dividend calculator helps you plan long-term. You can estimate income for years ahead. Consider dividend reinvestment plans (DRIP) too.

When dividends are reinvested, you buy more shares. This compounds your returns over time. Many investors use this strategy for wealth building.

At DivireInvest, we help investors understand dividend strategies. Our tools make income planning easier.

Comparing JEPI with Other Dividend ETFs

JEPI vs SCHD Dividend Strategy

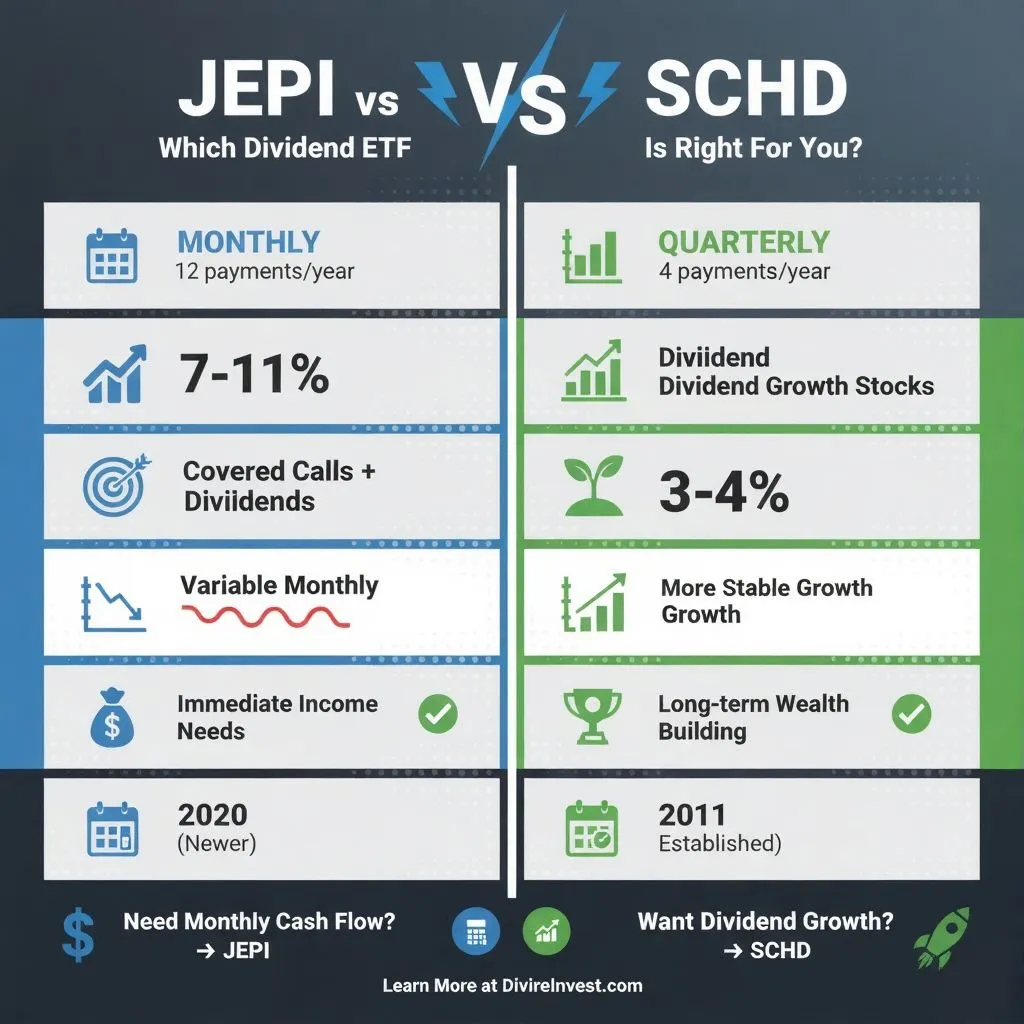

SCHD is another popular dividend ETF. However, these funds work differently. SCHD focuses on dividend growth stocks. JEPI uses covered call strategies.

SCHD typically pays quarterly dividends. JEPI pays monthly. For monthly income needs, JEPI might suit you better. You can compare using our SCHD Dividend Calculator.

Monthly vs Quarterly Dividend Payments

Monthly dividends provide regular cash flow. This helps with budgeting and planning. Quarterly payments come four times yearly.

Some investors prefer monthly income for living expenses. Others don’t mind waiting for quarterly payments. Your choice depends on personal needs.

Factors Affecting JEPI Dividend Amounts

Market Volatility and Premium Income

JEPI earns income from selling call options. When markets are volatile, option premiums increase. This can boost JEPI dividends.

Calm markets may result in lower option premiums. This affects monthly dividend amounts. Understanding this helps set realistic expectations.

Distribution Coverage and Sustainability

JEPI’s distributions come from multiple sources:

- Dividend income from stocks

- Option premium income

- Sometimes return of capital

Check the fund’s distribution coverage ratio. This shows if dividends are sustainable long-term.

Building Your JEPI Investment Strategy

How Many JEPI Shares Do You Need

This depends on your income goals. Let’s say you want $500 monthly income. If JEPI pays $0.40 per share monthly:

Shares Needed = $500 ÷ $0.40 = 1,250 shares

At $50 per share, you’d need $62,500 invested. Use a JEPI dividend calculator for your specific goals.

Dollar-Cost Averaging into JEPI

Don’t invest all money at once. Dollar-cost averaging reduces risk. Invest fixed amounts regularly, regardless of price.

For example, invest $500 monthly for 12 months. This spreads your entry points. You buy more shares when prices are low.

Tax Considerations for JEPI Dividends

Understanding JEPI Dividend Taxation

JEPI dividends receive mixed tax treatment. Some income qualifies as qualified dividends. Other portions may be ordinary income.

Qualified dividends get favorable tax rates. Ordinary income is taxed at your regular rate. Check your 1099-DIV form each year.

The fund may also distribute short-term capital gains. These are taxed as ordinary income. Consult a tax professional for personal advice.

Tax-Advantaged Accounts for JEPI

Consider holding JEPI in retirement accounts. IRAs and 401(k)s offer tax benefits. Dividends grow tax-deferred in these accounts.

Roth IRAs provide tax-free growth. This maximizes your dividend income potential. Traditional IRAs defer taxes until withdrawal.

JEPI Dividend Reinvestment Strategy

Benefits of Reinvesting JEPI Dividends

Dividend reinvestment accelerates wealth building. Each dividend buys more shares. Those new shares generate more dividends.

This creates a snowball effect over time. Your investment grows faster through compounding. Many brokers offer automatic reinvestment programs.

When to Take JEPI Dividends as Cash

Some investors need current income now. Retirees often prefer cash payments. This covers living expenses without selling shares.

If you’re still working, consider reinvesting dividends. This maximizes long-term growth potential. Switch to cash distributions when you need income.

Common Mistakes with JEPI Investing

Chasing High Yield Without Research

JEPI’s high yield attracts investors. However, yield isn’t everything. Understand how the fund generates income.

High yields can be risky if unsustainable. Research the fund’s strategy thoroughly. Don’t invest based on yield alone.

Ignoring Distribution Variability

JEPI’s monthly dividends fluctuate. Don’t expect the same payment every month. This differs from bonds with fixed payments.

Plan for income variability in your budget. Keep emergency funds for low distribution months. A JEPI dividend calculator helps estimate ranges.

Using JEPI in Retirement Planning

Creating Monthly Retirement Income

JEPI works well for retirement income planning. Monthly distributions match typical expense schedules. This creates predictable cash flow.

Combine JEPI with other income sources. Social Security, pensions, and other dividends diversify income. This reduces reliance on one source.

Withdrawal Rate Strategies with JEPI

The 4% withdrawal rule is common in retirement. With JEPI’s higher yield, you might not need principal. Dividends alone could fund expenses.

If JEPI yields 8% annually, you have cushion. You can reinvest excess or keep as emergency funds. This preserves your principal longer.

JEPI Performance Metrics to Monitor

Key Indicators for JEPI Investors

Track these metrics regularly:

- Current dividend yield

- Distribution coverage ratio

- Net asset value (NAV)

- Expense ratio

- Total return performance

These indicators show fund health. They help you make informed decisions. Most information is available on JPMorgan’s website.

Setting Realistic Expectations

Past performance doesn’t guarantee future results. JEPI’s high yield seems attractive now. However, dividends may decrease during tough markets.

Set realistic income expectations. Plan for potential dividend cuts. Diversification helps protect against this risk.

Maximizing Your JEPI Returns

Portfolio Allocation for JEPI

Don’t put all money in one fund. Diversification reduces risk. Consider allocating 10-30% to JEPI depending on goals.

Balance JEPI with growth stocks and bonds. This creates a well-rounded portfolio. Your age and risk tolerance guide allocation.

Rebalancing with JEPI Holdings

Review your portfolio quarterly or annually. Rebalancing maintains your target allocation. If JEPI grows too large, trim position.

Rebalancing forces you to sell high and buy low. This disciplined approach improves long-term returns. Automate rebalancing when possible.

JEPI Dividend Calculator Tools and Resources

Online Calculators and Spreadsheets

Many free JEPI dividend calculators exist online. Some brokers provide built-in tools. You can also create custom Excel spreadsheets.

A good calculator includes:

- Share count input

- Current dividend rate

- Reinvestment options

- Tax considerations

- Growth projections

Tracking Your JEPI Investment

Use portfolio tracking apps like Personal Capital or Mint. These tools monitor your investments automatically. They calculate dividends and total returns.

Regular tracking keeps you informed and motivated. You can see your passive income grow. This reinforces good investment habits.

Visit DivireInvest for more dividend investing resources. We provide calculators, guides, and investment strategies.

Frequently Asked Questions

Q: How much dividends does JEPI pay monthly? A: JEPI’s monthly dividend varies but typically ranges from $0.35 to $0.50 per share. The annual yield usually falls between 7-11%. Check current rates before investing.

Q: Is JEPI a good investment for passive income? A: JEPI can be excellent for passive income due to monthly payments. However, consider your risk tolerance and diversification needs. It works well as part of a balanced portfolio.

Q: How do I calculate my annual income from JEPI? A: Multiply your shares by the monthly dividend per share, then multiply by 12. For example: 100 shares × $0.40 × 12 = $480 annual income.

Q: Can JEPI dividends decrease? A: Yes, JEPI dividends can fluctuate monthly. The fund’s income depends on option premiums and market conditions. Don’t expect fixed payments like bonds.

Q: Should I reinvest JEPI dividends or take cash? A: This depends on your goals. Reinvesting grows wealth faster through compounding. Taking cash provides current income for expenses. Consider your life stage and needs.

Q: What is the minimum investment for JEPI? A: You can buy as little as one share of JEPI. At around $50-60 per share, it’s accessible to most investors. Some brokers allow fractional share purchases too.

Q: How is JEPI different from regular dividend stocks? A: JEPI uses covered call strategies to generate income. Regular dividend stocks pay from company profits. JEPI combines dividends with option premium income for higher yields.

Q: Are JEPI dividends qualified for tax purposes? A: JEPI dividends are partially qualified and partially ordinary income. The mix varies yearly. Check your 1099-DIV form for exact breakdown. Consider holding in tax-advantaged accounts.