Investing in ETFs like JEPQ can help you earn dividends while your money grows. Our JEPQ Dividend Calculator lets you estimate your total returns over time by reinvesting dividends (DRIP). Even if you’re new to investing, this tool shows how your investment can grow step by step.

Use this calculator to:

- Track potential dividend income

- Estimate total portfolio growth

- Compare growth with different investment amounts

Secondary Keyword: Dividend Reinvestment Calculator, DRIP Calculator

How the JEPQ Dividend Calculator Works

Our calculator is easy to use. You just need to enter:

- Initial investment amount (how much money you start with)

- Dividend per share (what JEPQ pays per dividend period)

- Price growth rate (how much the ETF price grows yearly)

- Dividend reinvestment (DRIP) option

- Additional contributions (optional extra money invested)

The calculator will then show:

- Total dividends earned

- Portfolio growth over time

- Final investment value

You can also try our main Dividend Reinvestment Calculator for detailed calculations across different ETFs.

JEPQ 10-Year Dividend & Price Growth

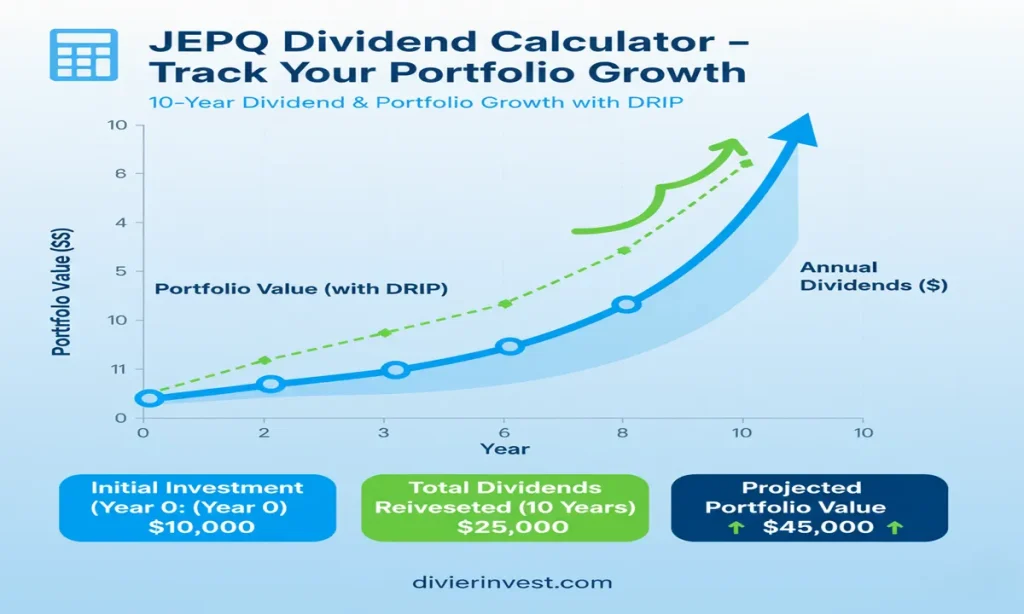

Here’s an example of how a $10,000 investment in JEPQ could grow over 10 years if dividends are reinvested:

| Year | Starting Balance | Dividends Earned | Ending Balance |

|---|---|---|---|

| 1 | $10,000 | $150 | $10,150 |

| 5 | $11,000 | $900 | $11,900 |

| 10 | $13,000 | $2,200 | $15,200 |

Why Use a Dividend Reinvestment Calculator

- Helps you see your money grow with JEPQ dividends

- Shows the power of compounding

- Easy to plan your long-term investment strategy

- Compare different growth scenarios in seconds

Tips for Using the JEPQ Dividend Calculator

Start with a realistic investment amount

Include price growth and dividend growth estimates

Use the DRIP option for maximum growth

Compare multiple scenarios to see how additional contributions affect your portfolio

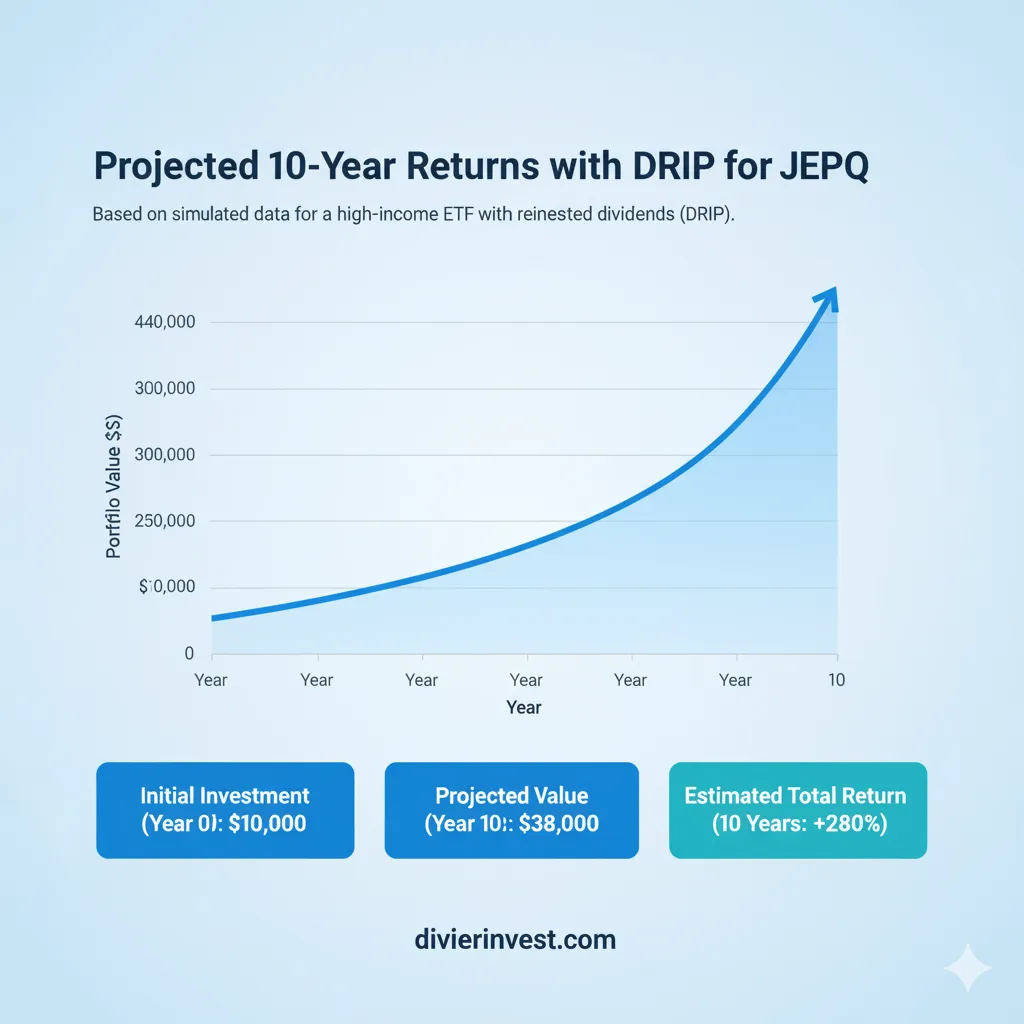

Projected Future Returns

Using historical CAGR numbers, here is an example of how a $10,000 investment in JEPQ may grow over the next 10 years:

| Metric | JEPQ Estimate |

|---|---|

| Starting Value | $10,000 |

| Estimated Annual Dividend | $150 |

| Estimated Portfolio Value (10 years) | $15,200 |

| Total Dividends Paid | $2,200 |

| Ending Balance | $15,200 |

Expanded Content – JEPQ Dividend Calculator Insights

Investing in JEPQ is a smart way to earn dividends while watching your portfolio grow steadily. With our JEPQ Dividend Calculator, even beginners can easily see how reinvesting dividends through a DRIP plan impacts total returns over 10 years.

Unlike simply holding the ETF, the calculator shows how compound growth works over time — meaning your dividends start earning their own dividends, accelerating your total investment growth.

Why JEPQ is Popular Among Dividend Investors

JEPQ is attractive because:

- It offers regular dividend payouts

- Historical performance shows steady price appreciation

- Using DRIP, your dividends automatically buy more shares, increasing your total holdings

- It’s suitable for both long-term growth and income-focused strategies

Internal Link: You can also explore DiviReinvest main Dividend Reinvestment Calculator to compare multiple ETFs and stocks.

How to Get the Most from the JEPQ Dividend Calculator

To maximize the insights from the calculator:

- Enter your starting investment accurately

- Add the current dividend per share for JEPQ

- Estimate annual price growth based on past trends

- Enable DRIP to automatically reinvest dividends

- Optional: Include extra contributions to simulate regular investments

This setup will provide a complete forecast, including:

- Yearly dividends earned

- Growth in portfolio value

- Total value after 5, 10, or more years

Understanding Long-Term Dividend Growth

Using historical data, JEPQ’s dividends have steadily increased, which is important for long-term investors. By tracking dividend growth:

- You can estimate how many years it will take to double your income from dividends

- Compare scenarios with and without DRIP

- See the effect of additional contributions on overall portfolio value

Pro Tip: Even small investments benefit significantly when dividends are reinvested, thanks to compounding.

| Year | Starting Balance | Dividends Earned | Ending Balance |

|---|---|---|---|

| 1 | $10,000 | $150 | $10,150 |

| 5 | $11,000 | $900 | $11,900 |

| 10 | $13,000 | $2,200 | $15,200 |

This table helps visualize how your $10,000 investment could grow with reinvested dividends over a decade.

Tips for Beginners Using JEPQ Dividend Calculator

- Always enable DRIP for maximum growth

- Track your portfolio annually to monitor progress

- Compare different growth rates to plan for realistic returns

- Add optional contributions periodically for better long-term results

External Link: Check Yahoo Finance – JEPQ Dividend History for dividend trends

FAQs

1. What does the JEPQ Dividend Calculator do?

The JEPQ Dividend Calculator helps you estimate how much your investment could grow over time through dividend reinvestment (DRIP). It combines price growth, dividend payouts, and compounding to show your potential total returns.

2. How accurate are the calculator’s projections?

The calculator uses historical averages and your inputs, like dividend yield and growth rate, to project future performance. While it’s not a guarantee, it offers a realistic forecast based on past JEPQ trends.

3. Can beginners use the JEPQ Dividend Calculator easily?

Yes! It’s designed for both new and experienced investors. Just enter your starting investment, dividend per share, and growth rate to instantly view projected returns.

4. What’s the benefit of using the DRIP (Dividend Reinvestment) option?

Enabling DRIP allows your dividends to automatically buy more JEPQ shares. Over time, this creates a compounding effect — your dividends start earning their own dividends, accelerating total portfolio growth.

5. How can I compare JEPQ’s growth with other ETFs?

You can use the same calculator to input data for other ETFs like JEPI, SCHD, or DGRW. This helps you compare their long-term dividend growth and total returns side by side.

6. Why is JEPQ a popular ETF among dividend investors?

JEPQ offers regular monthly dividends and exposure to top Nasdaq-100 companies, providing both income and growth potential — ideal for dividend-focused investors.

7. How often should I update my inputs in the JEPQ Dividend Calculator?

It’s best to refresh your calculations every few months or after dividend changes. This ensures your projections reflect the most recent dividend payouts and market performance.

Good work