Dividend Reinvestment Calculator – Track Your Portfolio Growth

Use the Dividend Reinvestment Calculator to see how your investments can grow over time. When dividends are reinvested, they buy more shares. These new shares earn more dividends, and over time the investment keeps growing like a snowball rolling down a hill.

- Fast & Free — Try interactive calculations instantly

- Real Results — See compounding & long-term growth

No signup • Data stays local • Accuracy depends on inputs

Dividend Growth Over Time

Detailed Yearly Breakdown

| Year | Start Balance ($) | Start Shares | Share Price ($) | Dividend / Share ($) | Dividend Yield (%) | Yield on Cost (%) | Annual Dividend ($) | Total Dividends ($) | End Shares | End Balance ($) |

|---|

Why Use This Dividend Reinvestment Calculator?

This simple yet powerful tool helps you visualize how your dividends can accelerate wealth growth through reinvestment.

It delivers fast, transparent, and reliable calculations designed for investors who value clarity over complexity.

Total Dividend Calculations

Avg. Annual Return Used (%)

Growth Scenarios Tested

What Is a DRIP (Dividend Reinvestment Plan)?

A Dividend Reinvestment Plan, also called a DRIP, allows investors to automatically reinvest their dividend income to purchase additional shares instead of receiving cash payments.

When a company pays dividends, that money is used to buy more shares of the same stock. These extra shares then earn their own dividends in future payments.

Over time, this process helps your investment grow faster through compound returns. Many investors call this the dividend snowball effect, where small reinvestments gradually turn into strong long-term portfolio growth.

Example of How DRIP Works

Imagine you invest $1,000 in a dividend-paying stock. Instead of taking cash dividends, a DRIP automatically uses that money to buy more shares.

Each time dividends are paid, your total shares increase. Those extra shares then earn dividends in the future, helping your investment grow faster over time.

This compounding effect makes DRIP a smart option for long-term investors.

Example of How DRIP Works

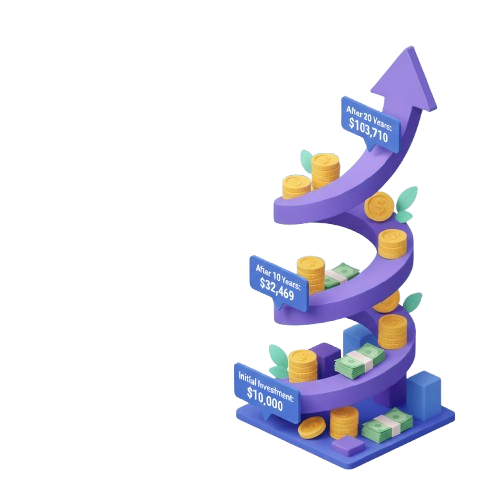

If you invest $10,000 in a stock paying 8% dividend, and both the dividend and stock price grow yearly (4% and 5% respectively), and you reinvest all your dividends, then:

- After 10 years, your investment grows to $32,469

- After 20 years, it grows to $103,710

This shows how a simple Dividend Reinvestment Calculator can help you see your long-term compounding growth.

Understanding the Risks of a DRIP Investment

Using a DRIP calculator, it’s important to understand that all investments carry some risk, and DRIPs are no different. Stock prices can fall, companies may reduce their dividend payments, and in rare cases, a business can stop operating altogether.

To manage these risks, many long-term investors prefer stable companies with a proven record of increasing dividends. A trusted list of such stable dividend-paying companies can be found here (external resource).

Common examples include:

Dividend Kings – Companies that have increased their dividends for 50 years or more

Dividend Aristocrats – Companies that have raised dividends for at least 25 years

Because of their long history of reliable dividend growth, these stable companies are often considered safer choices for DRIP investing over the long term.

High Dividend vs. High Growth Stocks – Which Is Better?

There’s no single best choice — it depends on your goals.

High Dividend (Low Growth)

- Pays you more cash now

- Grows slower over time

High Growth (Low Dividend)

- Pays smaller dividends now

- Grows faster in value long-term

Example: An ETF like SCHD (focused on high dividend growth) historically increased dividends by 12.82% per year and share price by 11.8%.

Using a Dividend Reinvestment Calculator, $10,000 invested for 20 years could grow to $162,044, outperforming an 8% yield stock by over $48,000!

Main Advantages of Dividend Reinvestment Plans

- Compound Growth: Reinvested dividends buy more shares, and those shares earn even more dividends.

- No Extra Fees: Many DRIPs reinvest dividends at no additional cost, making it cost-effective.

- Dollar-Cost Averaging: You buy more shares when prices are low and fewer when they’re high, reducing market timing risk.

- Automatic Reinvestment: Dividends are reinvested without manual effort — it’s a hands-free process.

- Long-Term Wealth Building: Ideal for investors focused on steady portfolio growth and retirement savings.

- Emotion-Free Investing: Keeps your investment strategy consistent by removing emotional decisions.

- Easy Portfolio Management: Great for investors who prefer a simple, automated approach.

- Tax Efficiency: You typically pay taxes when you sell, not on every dividend reinvestment.

FAQs About Dividend Reinvestment Calculator

Can I lose money with DRIPs?

How long should I keep reinvesting?

Is DRIP suitable for small investors?

Do DRIPs charge fees?

Are all companies good for DRIPs?

Investment Disclaimer

This Dividend Reinvestment Calculator and the information provided here are for educational purposes only.

They do not represent financial advice. Stock prices, dividend rates, and taxes can change at any time.

Always consult a qualified financial advisor before making any investment decisions.